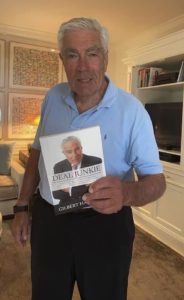

My guest for this podcast is Gilbert Harrison and he recently released a new book entitled “Deal Junkie: A Half-Century of Deals that Brought the Biggest U.S. Retail and Apparel Companies to Answer the Moment and Prepare for the Future.” Gilbert is the Chairman of Harrison Group, Inc. and the Founder and Chairman Emeritus of Financo, Inc. He founded Financo in 1971 in Philadelphia, where it became one of the leading independent middle market firms in the country, developing its reputation primarily in the retail and consumer industries.

My guest for this podcast is Gilbert Harrison and he recently released a new book entitled “Deal Junkie: A Half-Century of Deals that Brought the Biggest U.S. Retail and Apparel Companies to Answer the Moment and Prepare for the Future.” Gilbert is the Chairman of Harrison Group, Inc. and the Founder and Chairman Emeritus of Financo, Inc. He founded Financo in 1971 in Philadelphia, where it became one of the leading independent middle market firms in the country, developing its reputation primarily in the retail and consumer industries.

In this interview, we speak about his days of deal-making, his rise and leadership in different fields like retail, apparel, beauty, footwear and other merchandising and consumer-related companies.

If you want to know more about Gilbert Harrison, please click here to be directed to his website.

THE BOOK

Bringing public and private companies to the bargaining table to merge, sell or divest themselves is an intense high-wire act—and Gilbert Harrison’s Deal Junkie is an in-depth account of how a great practitioner of the art form has pulled off these kinds of deals over the course of five-plus decades in the business.

If it were your job to bring a company to the bargaining table so it could merge, sell or divest, you had better have the stamina and guts as well as an intricate knowledge of how the human mind operates. Negotiating these kinds of deals is not for the faint of heart. But for over fifty years, one merchandising giant after another—Marshalls, TJ Maxx, Home Depot, Nine West, Kohl’s, Macy’s, Sears, CVS, The Limited, Dollar Tree, Eddie Bauer, Interparfums, Jeffrey Stores, and Jos A. Bank, to name a few—have relied on Gilbert Harrison to help them forge just these kinds of deals. Have they all been signed, sealed, and delivered? No, that’s not how the game works, and getting many of these deals negotiated is exactly that—a game. In all deals, nobody knows who to believe or not to believe, and what a company’s objectives are. But whether buying, selling or divesting, it has been Harrison’s job to try and figure out the secret competing interests of a company and to get those deals across the finish line.

Deal Junkie is the story of Gilbert Harrison’s rise to becoming one of the true lions in the field of retail, apparel, beauty, footwear and other merchandising and consumer-related companies.

THE AUTHOR

Gilbert W. Harrison is the Chairman of Harrison Group, Inc. and a Senior Advisor in restructuring for GLC Advisors & Co. Mr. Harrison is the Founder and Chairman Emeritus of Financo, Inc. He founded Financo in 1971 in Philadelphia, where it became one of the leading independent middle market firms in the country, developing its reputation primarily in the retail and consumer industries. Over its 45 year history, Financo has expanded its service offerings significantly, developing resources beyond its traditional merger and acquisition and divestiture work into consulting, principal investments, restructuring and other services relating to the retail and consumer industries. As one of the industry’s premier dealmakers, Mr. Harrison has been involved in orchestrating over 100 merger, acquisition and divestiture deals for retail, apparel, footwear and cosmetic clients.

You may also refer to the transcripts below for the full transciption (not edited) of the interview.

Greg Voisen

Welcome back to Inside Personal Growth. This is Greg Voisen, the host of Inside Personal Growth. And joining me from Florida, you're in Florida today, right?

Gilbert Harrison

Just got back from Paris last week. And I'm in Florida now but it's windy. And yes.

Greg Voisen

Well, we have Gilbert Harrison. And Gilbert is the author of a new book called Deal Junkie. And I want to let the listeners know a tad bit about you, Gilbert. He was born in 1940 New York City. His family moved shortly thereafter to New Haven, Connecticut, where he was raised. He attended the Wharton School and then the School of Law, both at the University of Pennsylvania. His first job in law took him back to New York City where he practice corporate and securities laws. And after moving to Philadelphia, he joined blank Rome as an associate lawyer. Several years later, he and his fellow lawyers struck out on their own founding is it finical in the early in the 1970s. And from there, kind of the rest is history, as they say. So let me um, if you would, if you would, Gilbert, you know, like you're the deal junkie, tell the listeners a little bit about yourself your family history, which I thought was fascinating the book, earning your law degree, and then the formation of finance Co. And then ultimately, the sale of this to Shearson, Lehman American Express? And if you would, I think that kind of sets the tone for us continuing on with the interview because it gives people an idea about you.

Gilbert Harrison

Sure,I guess the best thing to say is, I was always an entrepreneur from early age. When I was 10 years old, I lived around the corner in New Haven, making 10 cents on a 50 cent program. And then parked cars at my friend's house next door and made $10. So program, I was in junior achievement at I went to the Wharton School. And then the summer before the Wharton School, I started a whole charter flight service to Europe, made 10,000 or $12,000. This is the 1962 6162 when it's hard to believe, when I started practicing law in New York, that three and a half years later, I was making $7,200. So that I've always been interested in entrepreneurship, building things and so on. When practicing law. I was doing corporate and securities law, and took companies public in mergers and acquisitions. And I always tell whoever loved the people interaction and the Goshi ation of these deals, as opposed to purely Thor, which led me to leave the practice of law in 1971. To start financial, as a boutique investment bank.

Greg Voisen

Well, Financo was quite a success. And then you sold to Shearson, Lehman American Express, and you know, in one of your chapters, because you're the deal junkie, you're the guy who's been out there working with all these retailers, doing mergers, doing acquisitions, and everything from both a legal standpoint, but even the psychology of the deal. You are like the psychologist of deals, and you speak about big egos of buyers and sellers in your chapter, and title, bringing some of the largest egos ever to walk the planet to the bargaining table. And you talk about your experiences with Les Wexner and Milton people. If you wouldn't tell the story about what you learned about the art of deal making in actually working with these two gentlemen, because they were probably as good or better deal makers than you are.

Gilbert Harrison

Richer than me, that's for sure. Yeah. And at the time, I mean, unfortunately, it's what? It's unfortunate what's happened to less it today, because he's really been dishonored, because of the Epstein thing. But he was one of the great merchant princes, and so was Milton. Milton was a retailer that had his hands on new every bit of his merchandise, no, every bit of his store profits on all 345 600 700 stores that he operated. Before the days of pure computers, he used to get printouts and, and would look over every single page and do his own analysis, which was fantastic. egos are something that I've seen with every probably every great person, whether it's because they think they're better than everybody else, in some cases, because they're insecure, which is interesting. And I won't tell you who I think is insecure, but there's a lot of people.

Greg Voisen

I'm sure, sure, I would, I would I might venture to say they might we might have had somebody in political office that was that way. Most recently. Not even saying the names everybody knows.

Gilbert Harrison

There's no question. There's no question about that. And I knew him. I knew him fairly well. And in fact, I had an interesting experience with him, because he called me into his office one day, and said, I want you to develop a whole licensing program for me. And we put together a whole package to give to him. And he said, this is fantastic. Let's go to work. So I said, that's fine. But before I go to work, we need to discuss my fee. And he said, fee? The honor and art of working with me, is going to bring you more success than you.

Greg Voisen

I love it. I was talking…

Gilbert Harrison

The egos by the way, he goes with this other person, Les Wexner. And the former president was even more interesting because I was having lunch and I think I mentioned that I mentioned this in my book. Um, I was lunch with Milton Petri and Les Wexner. And Les said he just came from his Scott, which was 100 to 210 feet. And Milton said, that's interesting. This is just on Donald Trump's yacht. And it's 215 feet. And we see less again in about another month. He says Milton Gilbert wash No, My boat is now 220 feet, he added five feet, make it larger.

Greg Voisen

Well, he goes, let's say he goes in your world or something you learn to manage very skillfully. And you're to be commended for that, because at from and coming from your law side, and then coming from the side of you that had to manage that that was really quite skillful of you. And you speak about this merchant prince, Martin Trump. And you tell us a little about, if you tell us a little about Martin, and how he recreated Bloomingdale's, what you learned and what he taught you about business life and becoming a great leader because in your eyes, you thought that Martin Trump was a pretty good leader.

Gilbert Harrison

You know, I've met an awful lot of what I'll call merchant princes over the years, from Wexner, who I talked about and bus Wexner and Mickey Drexler and Don Fisher. And Andre Mar from galleries Lafayette, and Stein, Marks and Spencer I can keep going on and on and on. But certainly the closest relationship I had was with Marvin, and he truly loved retail. He truly loved the customer. He loved the product. He loved being an innovator. He was just a pleasure to know and to work with, and he was a very hard working person. In fact, when I first started working with him, he had retired from Bloomingdale's, and he joined, he joined Fernando and as a senior advisor, and he says, we have a breakfast meeting tomorrow morning at 730. So I said Marvin, that's fine, but I have My trainer at seven says we use the trainer at six. Because that way you'll be ready at 730. That's what I do. So, I mean, he would, he would start working, he would I don't, we would take the Concorde to London or Paris working on some projects, he'd literally get off the plane and go right to a meeting, I was 20 to 30 years younger than him, I'd be tired, I want to go to the hotel, I want to shower and lie down for now.

Greg Voisen

Anyway, you learned a lot from him. You know, and you stated that over the past 50 years, you may have worked with hundreds, maybe 1000s of deals first as a lawyer. And then I said investment banker and financial advisor, what are some of the deals? And how could they have been prevented from falling apart? If the leaders had shifted their perspective and shift into a win mentality in your estimation? Gilbert, I

Gilbert Harrison

wish I could truly answer that question, because it's probably totally, totally frustrating. And how do you? How do you prevent these things from happening, and it's hard because you have to decide either want to become aggressive. And sometimes if you're aggressive, it annoys the person, if you're not aggressive, you don't get the deal done. You have to keep pushing, you have to get Givet speaking to them about the reasons. And it was a very frustrating experience. And the push to art and the client or the other party will say all you're interested in is your fee, you're not interested in the deal. And the fact that matters. If you look over the years, I've probably told people not to do more deals than I told them to do deals for reason. So you

Greg Voisen

know, giver used to have these annual events called the fine line co-founder and CO CEO forum and dance. And you invited the who's who of senior retail executives to be on the forum. What did you learn from these forums? And how did hosting these events really propel your business because I saw pictures in the book with you and all the guys sitting around. And it obviously looked like you were having a good time. But you give them with an intention of basically creating more deals,

Gilbert Harrison

let's Namco the fantasy CEO dinner was probably the most important thing that I could have done from a marketing point of view. While we were a boutique firm and known in the industry, we certainly didn't have the name the recognition or the manpower that a Goldman Sachs or Morgan Stanley, or some of the large investment banks had. So how do I build up my name? How do I build up our client base, we started with the NRF, a very small dinner that had six people at it to expand it to the last dinner I had, we had about 350 people at the seminar and over 120 people that dinner, which was by invitation only. And the whole purpose was to bring together retailers after the Christmas season to have them discuss what had happened, what their views were, where things were going in the previous year, and where they were looking forward to go in the current year coming up. And we had, in many cases, some very frank, interesting discussions. In some other cases, they were CEOs the quintile tell too much. Because there were public companies and they were in a quiet period because their sales hadn't been released. The event was extremely well attended, people that day, didn't know would want to come. The most annoying thing was that clients or potential clients that had chosen to go to other banks were insulted. They weren't invited, they beg, beg to come and I wouldn't let them. But all in all, it was a really interesting way for retailers that were in town for the National Retail Federation when it was the thing to do to get together. For us. It was a very important event because it created business. It created not only aware of the service of the firm, but also led to many deals that more than paid for the dinner itself. It was something I'm very proud of.

Greg Voisen

Well, you should be. And you know, the other thing that I remember reading the story is your long history with Wharton School, and you're very proud of that and you should be. And you received a BS in economics from Wharton in 1962. And an LL D and L LD in law in 65. And then he also taught a course called management 49. When there you were there. And I know you felt good about teaching that because you mentioned in the book, and then you said that it's been 40 years since you taught there, but many lessons you wish you could have imparted on the graduating students speak with us about some of those lessons, because after you left the course, you went out and got involved in all this other stuff. And this is the real hard life of learning the real hard lessons. What are some of those lessons if my listeners today are trying to put together a deal, or trying to successfully do a merger acquisition, or trying to successfully create a succession plan for themselves? What would you tell him as somebody who's had tons of experience with this?

Gilbert Harrison

By the way, this advice is not only for merger deals, it's for any type of business in many ways, although it can be personalized. First of all, confidentiality is essential. There are too many situations and opportunities that have been lost because somebody, in many cases at a lower level have broken, what is needed to be done. Second, you have to know your client, you have to know what they're interested in, why they're doing a deal. Why does the buyer want to buy something is because his business is slowing down? Because he wants to expand geographically, and so on? Why does the seller want to sell because they need to cap you really, as you mentioned before about being a psychiatrist, or psychoanalysts. That's what you'd have to do all the time. And this business, chemistry is extremely important in a deal. If you're working on selling a company, you better make sure that if the buyer wants the seller to retain that the business is such that it can be retained, if you're buying it just to buy locations, who cares. But if you're buying it from management, you better make sure that you take care of the management, you give them the incentives to keep them, what you don't want to do is pay an entrepreneur millions and millions of dollars, and then have him leave the day after the deal. Because he's the one that knows the business. We had a situation a number of years ago where you're talking about ego on some without a company to a UK company. And they decided that they were going to get rid of the entire management of the company and bring in their own people from the UK to run it. Guess what, three years later the business went bankrupt, and when closed down. So all of these things are probably one of the most essential things you've got to understand is you got to love what you do. I say this to people in class, I say this to the young people who work for me. It's fun to be an investment banker can be exciting, although there's still a lot of work that people need to do. And there's a lot of groundwork, it's an all isn't just getting on a Concorde and flying someplace or going to a city. How many cities have I visited where you fly in, you have the meeting, you don't go out to you don't go to the museum, you don't have dinner at the places that you do. So you really have to like you have to be able to take the pressure, you have to be able to understand and how the values are and not screw up your family. I've seen too many people that have gotten divorced, because the banker loses insight of what's important to him and look at the end of the day. Well, success in business and money is important. If people don't believe their family is still the most important thing. You got some real problems.

Greg Voisen

Good, good advice. I mean, I think most importantly, the last bit of advice which is look at your priorities in life, what is most important to you, and get those straight? You know in in, in 77 You wrote the book, you were hired by the owner of Ian Taylor stores. What's Richards last name?

Gilbert Harrison

My business switcher.

Greg Voisen

leaves to sell and tailor what you learn what did you learn about growing a brand as a result of selling and tailor?

Gilbert Harrison

I thought what did I learn a beverage relief is good and why the deal will tell you about that real quickly. Sure. We went to see the CEO of a multi-billion dollar company who was interested in buying and Taylor and we walk into his office in Chicago. The guy Pat's Richard, on his back and says Welcome to Chicago dick. And Richard turns around and says my name is Richard. As much as he wanted this business, the CEO called me the next day and said there's no way there's this is something I can't have somebody that's working for me that says something like Yeah, but growing up brand, I mean when we sold the Intel originally, finally to Garfinkel Brooks Brothers, I think the antenne stores The product was great the merchant merchandise was great. And it grew to where it was 50 stores when allied stores owned it, I think they had six 700 stores. Unfortunately, things fell apart during the Allied deal and it was spun off, its run some problems. Over the years, it's lost its inside, it had a phenomenal shoe business that they screwed up. And today, it is nowhere near where was in terms of product capability when I sold it. And there have been many businesses where they just haven't grown, that they grew dramatically, then they start growing too fast. Sometimes the pressure is on to keep expanding. If it's a public company, your earnings need to go up 10 to 15% every year. So they start building more stores. They start expanding, and they take their eye off of what's important.

Greg Voisen

Yeah, which is the brand which is coming out with good products, and which is retaining and attracting, and I would say more importantly retaining good customers that have brand loyalty. And that leads us to this question, actually, it's a great segue. Gilbert, speaking as someone with a history in the industry, knowing the volatility, and the uncertainty that retail has been dealing with. Where do you see the opportunities for new startups and for mergers, for existing retail brands, as we move into what I would call a blended world of online and brick and mortar?

Gilbert Harrison

Well, first of all, the world and the customer base still is looking for new exciting products they're looking for not the new me too. But they don't want things that are off the wall. But they think but they want things that are different, that are interesting. You haven't seen to an extent, the growth of some of these new businesses the way in, for instance, Home Depot, or Lowe's have grown from being you know, just hardware stores into multi unit stores the way some of the specialty stores have grown. It's hard to come up I mean, take a look, whoever thought that Apple would be what it is today, or Amazon would be in for the way it is. I mean, the insight that came from these unbelievable entrepreneurs, wonderful people have created whole new businesses, which goes me into the way the changes perhaps one of the biggest changes going on is E commerce. And the way global e Commerce has grown away globalization of businesses have grown. And now you're talking about the mega stuff that's going on. And the live streaming, it's incredible the way new things are developing. I'm sure they're not new retail formats in the sense that he's still saying the same old product. But there's new ways to reach the customer because the customers are changing. The other thing which I need to really put out is one of the biggest changes is companies have realized they have to give the consumer what they want, what the consumer wants, not what the company wants. And that's been perhaps the biggest change that I've seen over time.

Greg Voisen

Well, I think you mentioned that you look at Amazon runs a live streaming, Home Shopping Network runs live streaming, all of these companies that are selling retail women's clothing,

Gilbert Harrison

and finishing up a video for that was Tommy Hilfiger.

Greg Voisen

So all of these people, basically who are literally, you know, you look at online streaming, you mentioned it. And a lot of this stuff is occurring, as you know, 24/7 It's literally being aired all the time, catching people in the middle of the night in the middle of the day, whatever it is to retail their items, and then ship them via UPS, FedEx, and so on. So the whole world has morphed, but in 2012, you sold began calling created your own succession plan for someone who has created succession plans, put together mergers and acquisitions. What advice would you like to leave the listeners with might be considering their succession and our sale of their company to a larger entity.

Gilbert Harrison

First of all, be careful. Remember, you build the company and you want to make sure it ends up in the right hands. You want to make sure the chemistry is there. And you look don't lose your people. You want to make sure the product stays you want to make sure the company continues. Or maybe you don't care. Maybe you just want the money and you want to go way, but tried to bring in the right person to take over the business is very difficult for an entrepreneur, it's probably more difficult for the entrepreneur than it is for the professional management because the entrepreneur has always kept his hands on everything, and doesn't want to let go. I would also say, in many very successful cases, after the CEO has the new succession plan, the new CEOs in place, the old CEO will leave will drift off into the sunset or drift off to do something else, so that he's not standing Overwatch the way he should, why he would want to with the new management, he doesn't let them do its own thing. However, many times you find out they may have to come in, because the guy has done the wrong thing. And the business has suffered. And the board will throw them out and ask the old people to come back in. I think it's different with succession, whether it's a private company or a public company. But you have to do your homework, you have to check out who your successor is going to be. You have to check out what his reputation has been. Don't get fooled. It can be very, very difficult if it's not done correctly.

Greg Voisen

Oh, Gilbert, thanks for being on inside personal growth. For all my listeners will have a link to the book on Amazon. It's called deal junkie, Gilbert Harrison's and the deal junkie has given us some great insights, some great wisdom about putting deals together. Thank you so much for being on. Thank you for taking the time with our listeners. I'll be back in touch with you, Gilbert. I know you've got to get going. So thanks so much for your time.

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

Leave a Reply